Forex Trading Course for Beginner

Welcome you to the Khulna Forex Bazar Trading Course where we will

introduce you to the basics in trading, promote understanding and assist

you in your trading career.

The Course is Included

1) Introduction Forex

2) What is Forex Trading

3) How to start Forex Trading if I’m newbie

4) Trading Tools

5) Types of Analysis

6) Trend Line

7) Forex Market Hours

8) Money and Risk Management

For beginners of forex we advise to read, especially, first several sections of the course, including information on technical and fundamental analysis. They will help you to learn how to predict the financial market on the basis of generally accepted methods of analysis, build a simple trading strategy and begin trading on the basis of the most liked techniques.

1) Introduction Forex

The market in which currencies are traded. The Forex market is the largest, most liquid market in the world with an average traded value that exceeds $3.98 trillion per day and includes all of the currencies in the world. There is no central marketplace for currency exchange, trade is conducted over the counter. The Forex market is open 24 hours a day, five days a week and currencies are traded worldwide among the major financial centers of London, New York, Tokyo, Zürich, Frankfurt, Hong Kong, Singapore, Paris and Sydney. The Forex is the largest market in the world in terms of the total cash value traded, and any person, firm or country may participate in this market.

2) What is forex trading

Forex is the international business of trading currencies. The aim of a forex trader is to buy a currency when the price is low and sell it when it is high.The fastest way to make money It takes less than 5 minutes to open a forex trading account, and less than 1 hour to deposit funds, so you can start building your personal wealth quickly.

EXAMPLE:

Yesterday you bought 1 EUR at 1.50 USD. Today you sold that 1 EUR for 1.51 USD.

Congratulations!

You have just made a profit of $0.01 (1.51-1.50=0.01).

Now, $0.01 is a very small amount but we can take small amounts and create bigger profits out of them. In order to make the bigger profit you should trade a bigger volume of money, like thousands or millions of dollars. Just imagine you bought 100,000 EUR for 150,000 USD (100,000 EUR x 1.50 USD) yesterday and sold it today for 151,000 USD. You would have earned 1,000 USD on that trade in just one day!

3) How to start Forex Trading if I’m newbie

As we mention above that anyone can join this Forex market. First of all, you need to open a live trading account, verify the account by uploading your documents such as National ID Card, Passport, and Driving License for identity purpose and for address proof you need to upload your own name issued Bank Statement, Water Bill, Electricity Bill or any kinds of Utility Bill.

After verify your live trading account you need to add fund in order to start trading. After complete account opening process you need to download MT4 Platform and login there using your MT4 login information which one you receive in your email account registration time.MT4 Platform is an online based software where general people can Buy and Sell currency pair, Gold, Metal, Oil, Bond, Stocks etc. A trader can use this MT4 Platform many devices such as PC, MAC, Android, IOS, Tablet also Web Platform.

4) Trading Tools:

1. What is lot size?

2. What is pip?

3. What is the Spread?

4. What is Leverage?

5. What is Margin?

6. What is Stop Out?

7. What is Support and Resistance?

A standard trading term referring to an order of 100,000 units. Currency pairs are usually traded in units of 100,000 (standard lots), 10,000 units (mini lots) or 1,000 (micro lots) meaning buying / selling 100,000 of the base currency while selling / buying the equivalent number of units of the counter currency.

2. What is pip?

3. What is the Spread?

4. What is Leverage?

5. What is Margin?

6. What is Stop Out?

7. What is Support and Resistance?

TRADING TOOLS

(1) What is lot size?A standard trading term referring to an order of 100,000 units. Currency pairs are usually traded in units of 100,000 (standard lots), 10,000 units (mini lots) or 1,000 (micro lots) meaning buying / selling 100,000 of the base currency while selling / buying the equivalent number of units of the counter currency.

For example, if you open a Buy position of one lot for EUR/USD for the

ask price of 1.4000, you are purchasing 100,000 Euro while, selling

140,000 USD. A standard contract (one Lot) in which the USD is the

counter currency one pip will equal $10 ($1 for a mini lot). For all

other pairs exact pip values are slightly different and range from $8 to

$10

(2) What is pip?

A pip is a number value. In the Forex market, the value of currency is given in pips. One pip equals 0.0001, two pips equal 0.0002, three pips equal 0.0003 and so on. One pip is the smallest price change that an exchange rate can make. Most currencies are priced to four numbers after the point.

(2) What is pip?

A pip is a number value. In the Forex market, the value of currency is given in pips. One pip equals 0.0001, two pips equal 0.0002, three pips equal 0.0003 and so on. One pip is the smallest price change that an exchange rate can make. Most currencies are priced to four numbers after the point.

For example, a five pip spread for EUR/USD is 1.2530/1.2535. In the

major currencies, the price of the Japanese yen does not have four

numbers after the point. In USD/JPY, the price is only given to two

decimal points – so a quote for USD/JPY looks like this: 114.05/114.08.

This quote has a three pip spread between the buy and sell price.

(3) What is the spread?

The spread is the difference between the buy (also called bid) price and the sell (also called ask) price. Two prices are given for a currency pair. The spread represents the difference between what the market maker gives to buy from a trader, and what the market maker takes to sell to a trader. If a trader buys any currency and immediately sells it - and no change in the exchange rate has happened the trader will lose money. The reason for this is that the bid price is always lower than the ask price.

The spread is the difference between the buy (also called bid) price and the sell (also called ask) price. Two prices are given for a currency pair. The spread represents the difference between what the market maker gives to buy from a trader, and what the market maker takes to sell to a trader. If a trader buys any currency and immediately sells it - and no change in the exchange rate has happened the trader will lose money. The reason for this is that the bid price is always lower than the ask price.

For example, the EUR/USD bid/ask currency rates at your bank may be

1.2015/1.3015. This represents a spread of 1000 pips. This spread is

very high compared to the bid/ask currency rates for online Forex

investors, such as 1.2015/1.2020 - a spread of 5 pips. In general,

smaller spreads are better for Forex investors because a smaller

movement in exchange rates lets them profit from a trade more easily.The

spread is where the market maker will make their money.

(4) What is Leverage?

The ratio of the transaction

size to the actual investment used for margin. Leverage allows a client

to trade without putting up the full amount. Instead a margin amount is

required. For example, 50:1 leverage, also known as 2% margin

requirement, means $2,000 of equity is required to purchase an order

worth $100,000. 400:1 leverage means $250 is required to purchase an

order worth $100,000. Leverage increases both upside and downside to

risk as the account is now that much more sensitive to price movements.

(5) What is Margin?

The word ‘Margin’ simply refers to the amount of money that you need to have in

your account or futures margins refer to the minimum required balances to place

a trade. It is a good faith money. Margin requirements for most futures

contracts range from 2% to 15% and are set by the exchanges based on

volatility.

(6) What is Stop Out?

Stop Out is an order for

compulsory closing trading position (s) in the case of an insufficient number

of free margin. This order is generated by the trade server. Stop out is the

state of account when the marginal rate falls to a specified broker-level or

even lower. As a result, the broker immediately closes all open trading

positions in order to avoid losing money. Stop out fear as a trader and broker

of the utter bankruptcy of the account. Stop out is a critical level of losses,

which operates automatically to prevent a capital loss. As a result, the

availability of such insurance, the trade balance is always positive.

Calculating stop out is determined depending on the number of open positions

and account status. The formula for calculating this level the following: Stop

out = ((balance + floating profit - floating loss) / Margin) * 100%. Stop out

is described in percentages.

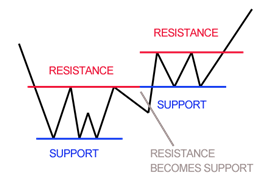

Look at the

diagram above. As you can see, this zigzag pattern is making its way up

(bull market). When the market moves up and then pulls back, the highest

point reached before it pulled back is now resistance.

As the market continues up again, the lowest point reached before it

started back is now support. In this way resistance and support are

continually formed as the market oscillates over time. The reverse is

true for the downtrend.

5) Types of Analysis

There are three main types of forex analysis, technical forex analysis and fundamental forex analysis and sentiment forex analysis.

There are three main types of forex analysis, technical forex analysis and fundamental forex analysis and sentiment forex analysis.

Fundamental:

Forex analysis bases the valuation of an asset (in our case a currency) on important economic reports. An example could be represented by the comparison of the employment reports of two countries. In this case, we could use the information of the reports to predict a decrease in value of the currency with the worse report and therefore to create a strategy that maximizes the earnings on the employment trend.

Forex analysis bases the valuation of an asset (in our case a currency) on important economic reports. An example could be represented by the comparison of the employment reports of two countries. In this case, we could use the information of the reports to predict a decrease in value of the currency with the worse report and therefore to create a strategy that maximizes the earnings on the employment trend.

Technical:

Forex analysis is based on historical behavior of the forex market and therefore we can say it consist of taking strategic decisions based on what happened more than on what we think it would be. Many forex traders use a combination of technical analysis as well as fundamental analysis since it grants more flexibility and integrates technical forex analysis with the connection to everyday events.

Forex analysis is based on historical behavior of the forex market and therefore we can say it consist of taking strategic decisions based on what happened more than on what we think it would be. Many forex traders use a combination of technical analysis as well as fundamental analysis since it grants more flexibility and integrates technical forex analysis with the connection to everyday events.

Sentiment:

Sentiment analysis is a type of forex analysis that focuses on identifying and measuring the overall psychological state of all participants in the market. Sentiment analysis attempts to quantify what percentage of market participants are bullish or bearish. Once the majority sentiment is identified, a sentiment analyst will often take up a position on the opposite side on the assumption that the crowd is wrong.

6) Trend Line

There is a famous saying in the trading world, which is

“Trend is your Friend”. While by just following the trend is not a guarantee

that you will make profit, it increases your winning probabilities immensely. One simple and effective way to see on what direction is the trend, or if there

is no trend at all, is to use a Simple Moving Average on a high timeframe. If

prices are above the Simple Moving Average line, then there is an uptrend, if

they are below there is a downtrend, while if they more or less in the middle

then the pair is ranging (no trend).

Here are 3 examples of pairs are in an uptrend, downtrend, and ranging.

7) Forex Market Hours

This section of the website will help clarifying the concepts of Forex Market Hours and Forex Trading Sessions. One of the main advantages of Forex markets is that they are open during all working weeks – from Sunday 10:00 P.M (GMT) to Friday 10:00 P.M (GMT). Now it is logical to ask yourself a question – What times are the best for trading within Forex Market Hours?

Generally talking, the most interesting Forex Trading times are between the opening of the London stock exchange begins its activity, around 8 A.M. (GMT), and the closing of the American market, which takes place around 10 P.M. (GMT). The most hectic time in the Forex market is when the London stock exchange overlaps with the American market between 1 P.M. (GMT) to 4 P.M. (GMT). These are the times which can be considered as the most liquid or when the most Forex traders are trading in the markets. If your interest is to do day-trading this the way you should use to make trades.

Forex Trading Sessions

There are four trading sessions

in the Forex market, which take place every working day when the Forex markets

are open: The Pacific trading session, the Asian trading session, the London

trading session and the New York trading session.

London trading session

London trading session

The London trading session starts about 8 A.M. GMT and ends at around 4 P.M.

GMT. The most active Forex currencies during this time frame are GBP, EUR and

USD

New York trading session

New York trading session

The New York trading session starts at about 1 P.M. GMT and ends at about 10

P.M. GMT. The most active Forex currencies during this time frame are EUR, GBP,

AUD, JPY, and USD.

Asian trading session

Asian trading session

Asian trading session very often is the quietest session of the Forex market.

All currencies move very slow and it’s not a very good time to day-trade. The

only real Forex currency in this period, which has newsworthy activity, is the

JPY and the activity is slow until the main financial events happen.

Pacific trading session

Pacific trading session

Pacific trading session begins when Australian and the New Zealand markets

open. This is one of the quietest sessions for Forex trading. Majority of

traders’ activity is focusing on the currencies: AUD, NZD, USD.

8) Money and Risk Management

8) Money and Risk Management

Before you start trading, you

have to understand that money and risk management is the most important step to

take as a trader. The number one reason for traders losing their all money is

the lack of a proper money and risk management strategy.

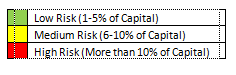

As a general rule, you should not

take risk more than 5% of the capital you invest on a single position. Some

traders are comfortable to risk as much as 10%, but you should never exceed

this amount. Below is a useful guide that shows the maximum volume (lot) to

open on a single position, according to how much money you have invested and

according to your stop-loss (examples of 10-pip and 15-pip stop loss are given.

It is highly recommended to choose a green and maybe a yellow area, but to

avoid red.

Gold is riskier to trade due to

high volatility; however more profit (or loss) can be made in relation to the

margin needed in comparison to currency pairs. Below is a recommended risk

strategy of trading gold.

Hello, I would like to appreciate your work. It’s a great platform got to learn a lot. Your data is really worthy. Thank you so much. Keep it up!

ReplyDeleteForex Trading

Forex Market

Always Welcome!

DeleteSuch a great article i have read... this is a amazing blog... thank you for sharing this blog with us..

ReplyDeleteForex Course

Thank you for reading our article, you are welcome.

Deletei want do the business, how to possible it.

ReplyDeleteWelcome to forexbazar. If you are interest to join forex trade with us, please contact us 01719686866

DeleteReally it’s a wonderful guide with good resources. We also offer some beginners guides in stock market section. Checkout our Stock Investor website for more latest stock market update.

ReplyDeleteHow does Forex Market Work?

How Nifty is Calculated?

Thank you

DeleteHello .I am into stock trading and We currently have an ongoing offer on which you can earn up to $3550 every 7 days and you don't get to trade by yourself as we will handle that .

ReplyDeleteIf you are interested kindly contact me aminullahrustamani@mail.com

ReplyDeleteJust wanted to say a BIG thank you to Sir Carlos for handling the trading of my account. Your professionalism, genuine kindness at times when I needed to face reality are what made me progress.

I invested $800 and got $8000 in 10 days . I only wish I had known about you earlier from the first moment I decided to trade. Nevertheless, I am grateful!

if you are interested in starting up an in investment with him contact him via

email.tradewithcarlos2156@gmail.com or

WhatsApp +17152550638

Black Magic Removal Expert, Black Magic Protection, Breaking and Reversing of Black Magic Spell Curses. Call ☎ +27765274256

ReplyDeleteBlack Magic Removal Expert, Black Magic Witchdoctor. In San Diego, San Francisco, Los Angeles. Call ☎ +27765274256

Black Magic is the evil spell from a person tries to gain selfishness or else to harm someone else.

By taking the help of Black Magic, they make someone suffer and imprison them. Otherwise, they should subdue others and get them to do what they want.

Anyone can experience agony due to the evil spells of Black Magic. If you are not getting idea about how to remove Black Magic then consult with Astrologer who have expertise in Vedic Astrology.

The experts trained under Sheikh Hussein have provided personalized help to the ones in need and received rave reviews for the solutions.

Before going anywhere else, consult a Black Magic Removal Expert.

Black Magic has been practiced for centuries and is well spread in every nook and corner of the world, which is an ancient art.

Different communities, cultures and countries to present this art as their style and exceptional performance can be taken as the mysterious art.

Black Magic can really play havoc with the life of the target person by destroying any aspect of life may it be career/business or wealth/prosperity.

Creating family problems or unnecessary tensions/phobias, adversely affecting children & family.

Creating chronic health problems, destroying mental peace, intelligence & happiness, cause inner turmoil, unrest & uncharacteristic/abnormal behavior and even cause unnatural deaths in extreme circumstances.

Black Magic not only affects the circumstances and future prospects of a person, but also deprives him materially of everything he was destined for.

But also affects the psyche of the victim in such a way that he loses the willpower & mental energy to get out of the dark situation he is in and has no desire to live or rise in life.

The effects of Black Magic become more chronic, dangerous, and fatal with time, if untreated, like a horrible disease.

It starts spreading like a contagious disease, affecting the person’s mind, brain, body, relationships, attitudes, work, money, marriage, career, and everything in life.

Breaking or reversing Black Magic Spell Putting a Black Magic spell on someone is very easy for those knowing even a little bit of Voodoo.

Sheikh Hussein the Black Magic expert to rectify its consequences.

Sheikh Hussein is the Black Magic specialist who operates in Southern Africa (Namibia, Botswana, Swaziland, South Africa and Lesotho) to solve your all problems.

I make sure to provide effective solution to the problems faced by my clients and serves best problems solutions.

"Every kind of problem solution with guaranteed quick results."

Are you looking for the best online help?

Have you been searching all over the Internet to find professional help?

Then you have come to the right place contact me now.

I am determined to offer exactly what you’re seeking. Fast and everlasting results!

For Powerful Ancient Black Magic Spells

Call Sheikh Hussein Now on ☎ +27765274256

Email: sheikhhussein@protonmail.com

Visit: https://sheikhhussein.com

Nice post. Thanks for this amazing post because its very helpful for me in my learn stock market.

ReplyDeleteYou will also learn about market trends, support and resistance, heads and tails, and chart patterns. In addition to the basics of foreign exchange trading, a Forex trading course will teach you about the economics of currency markets and how to use them. Get detailed info about forex trading on this website.

ReplyDeleteNice articles and your information valuable and good articles thank for the sharing information forex trade

ReplyDelete